BVNK enables PayPal USD (PYUSD) in a step forward for mainstream adoption of stablecoins

- BVNK integrates US dollar-pegged stablecoin PYUSD into its payments platform.

- Issuer Paxos approved BVNK as a partner, meaning BVNK can create (mint) and remove (burn) PYUSD tokens directly for its customers.

- As a stablecoin that connects to PayPal’s global network, PYUSD is a valuable payment option for global businesses.

- Stablecoins account for 70% of blockchain transactions. The total market cap of stablecoins reached $160bn in April and there is $300m of PayPal USD in circulation. Monthly active stablecoin users are on the rise, reaching 27.5 million unique users and 47 million active stablecoin wallet addresses in April.

BVNK, the payments infrastructure provider, announced today that it has integrated the stablecoin PayPal USD (PYUSD). Paxos Trust Company, overseen by the New York Department of Financial Services (NYDFS), is the sole issuer of PYUSD. Please note PYUSD is not regulated in the UK. Don’t invest unless you’re prepared to lose all the money you invest. Crypto is a high risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

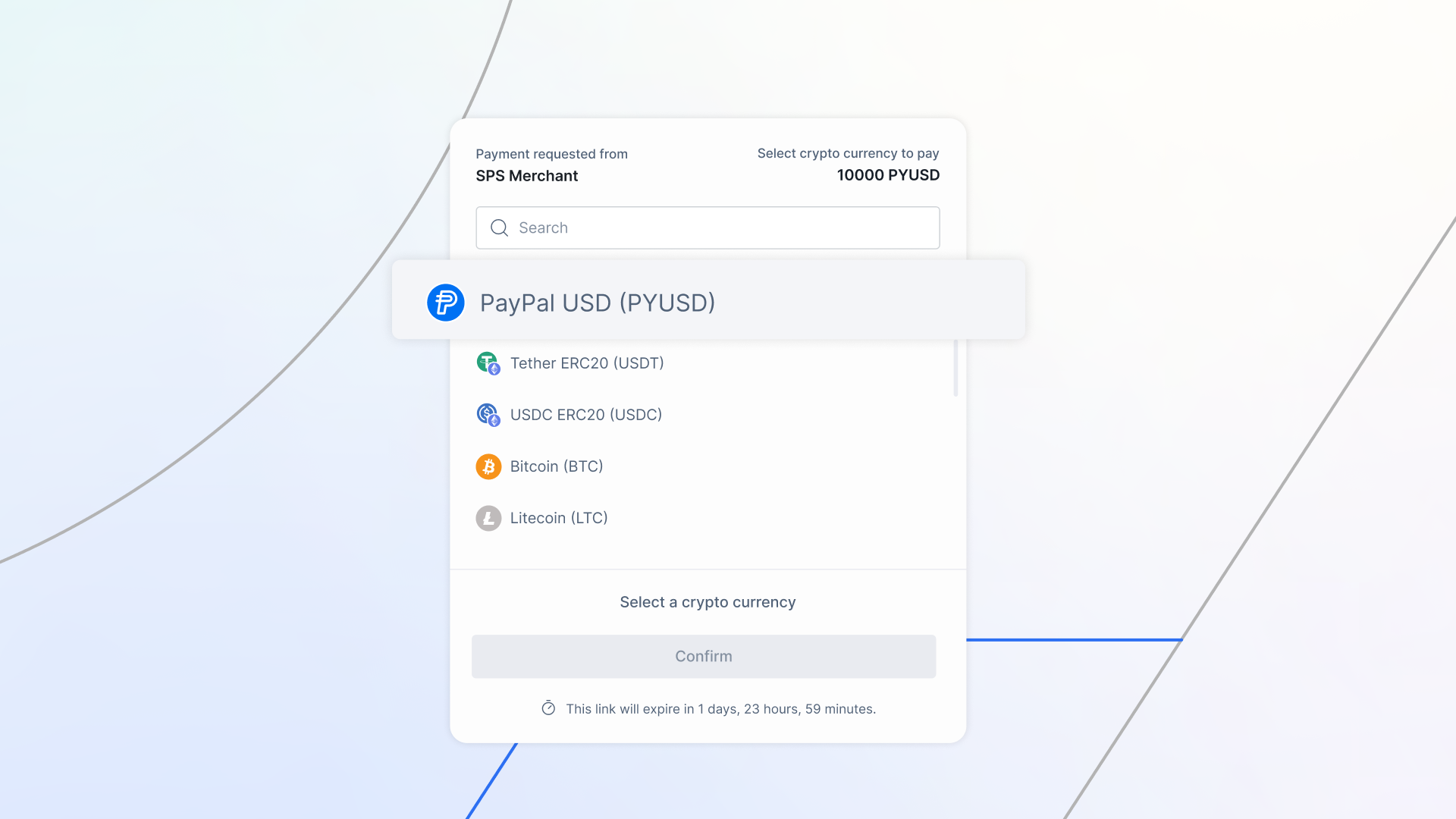

Businesses can access the US dollar-pegged PYUSD stablecoin on BVNK’s payments platform, alongside 14 of the most popular digital currencies, leading stablecoins and 25 fiat currencies. As an approved member of the PYUSD ecosystem, BVNK has direct access to create (mint) and remove (burn) PYUSD tokens for customers.

BVNK co-founder and VP Commercial Strategy Chris Harmse, said: “We’re building modern payments infrastructure to enable more businesses to operate across banks and blockchains and maximise financial flexibility. Stablecoins make up almost 90% of the payments we process, and they’re very important to our customers as a way to settle global payments efficiently. We’re thrilled to introduce PYUSD to our platform. As a stablecoin that connects into PayPal’s extensive payments network, it’s a valuable payment option for many businesses.”

Nick Robnett, Head of Asset Growth at Paxos said: “As a dollar-pegged stablecoin that is issued by Paxos Trust Company, which is overseen by New York Department of Financial Services, PYUSD is bringing greater trust to digital assets. We're seeing growth every day as it’s rolled out across the PayPal ecosystem – and we’re delighted to team up with BVNK to give more businesses access to PYUSD, and more options for how they move their money globally.”

With this new integration, BVNK customers can create PYUSD wallets, settle suppliers, pay contractors and employees around the world and accept consumer payments in PYUSD – through BVNK’s API, hosted payments page, or merchant portal. They can also settle PYUSD into fiat currencies like EUR and GBP.

Stablecoins are one of the fastest growing crypto assets. They’re less than a decade old, but more than 7 trillion dollars of stablecoins were settled on blockchains in 2023. This year, monthly active stablecoin users are on the rise, reaching 27.5 million unique users and 47 million active wallet addresses in April.

Today stablecoins account for nearly 70% of transactions on the blockchain, eclipsing more established digital currencies like bitcoin. At the end of April, the total market cap of stablecoins reached $160bn after eight consecutive months of growth – the highest market capitalisation for stablecoins since September 2022.

PYUSD is an ERC-20 token operating on the Ethereum blockchain. Despite only launching in August 2023, 11 million people traded PYUSD in its first six weeks. In April 2024, it reached a market cap of $320 million.

PYUSD represents a new breed of stablecoin. Issued by Paxos Trust Company, which is overseen by the New York State Department of Financial Services (NYDFS), PYUSD is fully backed by US dollar deposits, short-term US treasuries and similar cash equivalents, and can be redeemed 1:1 for US dollars.

It is important to understand that stablecoins create an exposure to counterparty risk, which may mean assets become unavailable during an insolvency event, and stablecoin value is not guaranteed. Take a few moments to learn more about stablecoin risks, here.

Financial Promotion approved by: Archax Limited. Date: 03/04/2024