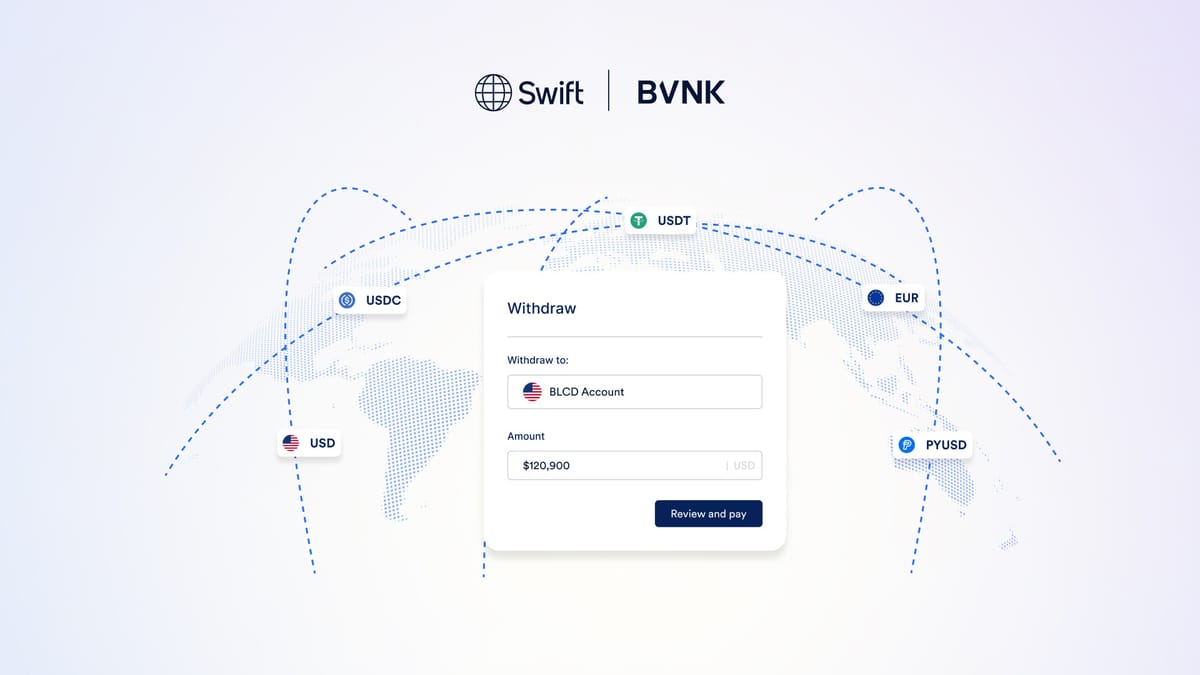

BVNK launches US dollar payments via Swift, enabling global businesses to access its stablecoins services

- BVNK enables Swift payments, so customers can on- and off- ramp to stablecoins via major fiat currencies, USD or EUR.

- The Swift system handles around 45 million transactions per day. The Euro and U.S. dollar are involved in more than 7 in 10 Swift payments worldwide in 2024.

- Stablecoin holders reached an all time high in April of almost 100 million, with around 30 million monthly active wallet addresses, while total market cap has topped $150bn.

BVNK, the stablecoin payments provider, announced today that it has enabled Swift payments on its platform, so businesses can move easily between US dollars, Euros and stablecoins like USDT, USDC and PYUSD.

With these new capabilities, BVNK customers can tap into more efficient global settlement and do business with global partners more easily:

- Payment service providers (PSPs) and fintechs facing increasing demand to move money faster globally, can send US dollars or Euros to the BVNK platform, convert it to stablecoins and make near-instant onward payouts to clients and partners.

- FX trading platforms with their global customer base can receive funds in stablecoins from local payment providers, automatically convert to US dollars, before sending to their own bank accounts – all within the BVNK platform.

- Businesses accepting stablecoins in international markets via BVNK’s crypto payments gateway, can convert the funds automatically to US dollars or Euros and send to their bank accounts via Swift.

Maxim Ivanov, Director of Product, Core Banking said: “We know that modern businesses want financial flexibility so they can work in the most capital-efficient way. They want to move funds faster around the world, for less cost and risk. By bringing together bank and blockchain payment rails and currencies in a single platform, we enable this for our customers. Adding USD and EUR via Swift means that our customers can really take full advantage of stablecoins to speed up their money movement, wherever they are based – and they can easily get back into fiat currencies if and where they need to.”

The head of payments at a leading FX trading platform, said: “As a global business, we work with numerous PSPs across various regions and currencies. With the increasing demand for fast and convenient transactions, settlement from our PSPs in stablecoins has become essential. Thankfully, BVNK stepped in, providing us with a seamless solution to receive stablecoins, convert them to USD—our primary currency—and transfer them directly to our bank accounts via Swift. BVNK offers the perfect pathway from our PSPs to our banks, saving us valuable time and money. Now, onboarding PSPs is worry-free, as we always have a reliable way to settle with BVNK.”

With BVNK’s platform, businesses can access 14 of the most popular digital currencies, all the leading stablecoins and 15 fiat currencies.

It is important to understand that crypto creates an exposure to counterparty risk, which may mean assets become unavailable during an insolvency event, and crypto value is not guaranteed. Take a few moments to learn more about the risks, here.